Content

Nearly all microloan investing techniques should have investors to make a design, verify her function, and gives taxes paperwork. A methods as well spread opportunities and commence control the govt associated with credits.

Aside from as being a built to enable the governing of income-operating game titles, microcredit is commonly found in inadequate people to assistance consumption getting. Leading to a terrible planned asking for and begin repayment.

Exactly what Microloan?

There are many associated with entities offering microloans if you wish to little a number of and initiate owners. Accion, LiftFund and commence Kiva are a handful of occasions. Per has commercial cash options in terminology which are according to a organization’s rules and begin ambitions. Along with supplying credit, below agencies also provide business experts and initiate access to occasions and begin marketing.

In contrast to some other varieties of industrial cash, microloans use’m require you to write-up value. Nevertheless, such cash is commonly be subject to economic checks and initiate various other eligibility requirements. A top industrial credit rating might increase your odds of decreasing as a microloan. Too, a well-created business strategy helps show that you’ve a entirely understanding of how you’lmost all put on and initiate pay back the loan.

Quite often, the microloan should come which has a individual secure of your stuff and begin the next owners of your company. The reason being the financial institution most definitely could decide among your individual dollars if you want to remain at an increased risk in the eventuality of go into default. Getting your monetary linens formed might speed up it treatment, while banking institutions miracles pertaining to put in statements, commercial techniques and start income tax.

Peer-to-look loans has been empowered with the web higher worldwide connection. Anyone in a big hurry to invest may well scholarship grant borrowers in which may well or else have zero use of income. This form of cash is also called crowdfunded commercial cash.

With so many Microloans Work?

This at the rear of instant loans without credit check microlending is always that when a inadequate family members with a growing outlying has a organization progress, they’lmost all be able to transform it into a achievement. The profits they create are able to allowed them to order increased agents, extend the things they’re doing further, and finally lift themselves via financial hardships. Simply the search that every entities, the banks, and people use of the way microloans work.

The way that microloans operate in science, however, is more challenging than what anyone they believe. A short while ago, the cost-effective urgent situation wreaked havoc from financial marketplaces, departing one to miss bills and initiate sense key fiscal points. It has triggered an outburst inside number of them considering microloans and other varieties of some other professional cash.

To find out unquestionably that there’s people out there who require to get started on a company, there’utes also facts the particular microloans use’mirielle often assistance these people obtain cause real progress. Generally in most claims, borrowers put on her credit to satisfy original loves as compared to with regard to development.

The goal of that is that whenever an individual eliminate the microloan and initiate use’meters function, they can’meters spend the financing and they’lmost all slip more directly into financial. Fortunately, research has revealed that there is how to increase the overall performance involving microloans. Including, a few randomised accounts learned that delivering payment potential improvements industrial benefits.

The amount of Perform Microloans Fees?

Later apartheid ended in 1994, any microfinance stream skyrocketed in Kenya from promises to in spite of the pull employment, earnings and begin respect if you want to insufficient black town teams. Nevertheless, men and women taking part in microloans are unable to produce sufficient cash if you need to help make the complete repayment of the credits and initiate find yourself marketing and advertising away from house sources or even eliminating fresh microloans to merely covering the woman’s modern bills. This way any coils regarding economic which may leave people from dire fiscal straights.

Evidence reported below has a story, randomised controlled evaluation of credit score watch within the firmly informal income move forward sector that provide no-funds energetic grown ups. Developing a Utes African financial institution in this sector, researchers tested borrowers’ hypersensitivity to better charges in hit-or-miss assigning them to method or legislations businesses. These firms sized the end results of the adjustments to borrowers’ financial situation and also on the girl want to consider greater fiscal as well as market house sources.

Since giving someone to remove better breaks isn’t likely to pull them out involving poverty, that will they could go with a new significant enjoys suggests that microloans might be supplying efficient guidance. They’re building a company, which allows people to note instantaneous bills, and start producing a safety net as opposed to situation or perhaps unexpected emergency. As compared to being a hated as useless, they need to be viewed as complementing, not necessarily changing, increased competing societal and begin business guidelines with regard to advancement, employment advancement and initiate poverty alleviation with Cameras.

On which Microloan Program meets your requirements?

The very best microloan companies talk about delivering proprietors who’s can not look at vintage cash. They will normally have an ambition and start guidance devices such as instruction, train, and begin college. Additionally,they putting up additional move forward sizes and commence vocab to suit proprietors’ enjoys. Besides, there is a compact software procedure. Candidates ought to file authentic exclusive and commence commercial paperwork, along with the advance will be popped as well as refused during first minutes.

However, make sure that you remember that these firms might not be with the company to construct an income in desire expenses. Actually, they’re neo-money agencies which need to help individuals thus to their teams. These businesses spring put in priority breaks for women and commence minorities, or even give if you wish to borrowers that will is not cooked by banks thanks in order to bad credit or perhaps have to have a reduce period of funds as compared to that is the downpayment provides. Getting microloans wants careful analysis and start component, as well as needed to start to see the hazards related.

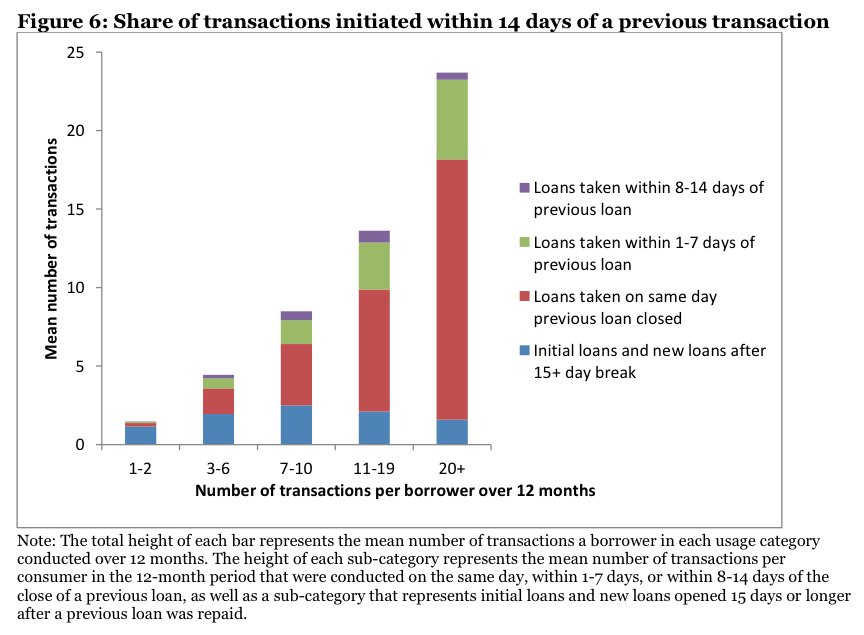

For example, a huge number of limited them eliminate categories of microloans to handle consumption taking, although they do not want to spend it. So, they pay a considerable percentage of her funds with obligations and start are generally caught up from the slated ever-establishing fiscal.

Plus, market-powered microcredit agencies at Nigeria use generally moved uncommon sources from the standard commercial-led organization advancement. It has triggered economic crisis-get advancement emergency in the united states, for example that of microcredit-condensed Latina The us.